A review of EasyFinancial Loans: Everything you need to know

Who is EasyFinancial for?

Everyone! Yes, you read that correctly. EasyFinancial personal loans are great for Canadians who need an urgent loan for home repair, educational expenses, emergency medical expenses or for any other reason. Now, there are several lenders out there that provide similar loans. However, what makes EasyFinancial stand out is the fact they also cater to people with bad credit scores.

Banking and credit maintenance can be difficult. It is often too confusing, and sometimes people end up sabotaging their credit score and history. This makes it difficult to get qualified for personal loans or repay existing loans. Most banks will not give a loan in such a situation.

EasyFinancial understands this need. They provide instant, easy cash flow to people in need. Their process is also relatively easy to follow.

Are you eligible for this service?

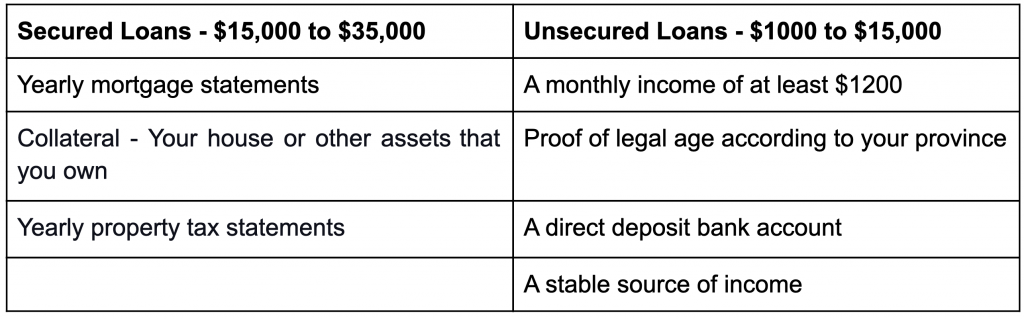

While the loan is easy to avail for most people, there are certain requirements you need to meet to be eligible.

What can I get out of this service?

Now that you know whether or not you’re eligible, the next question is, what can EasyFinancial do for you? EasyFinancial provides secured loans of up to $35,000 and unsecured loans of up to $15,000. The term for their loans is flexible. It depends on the loan type you opt for and your specific financial situation. All their loan plans are well structured to cater to your individual financial needs.

The interest rates for any of their loans range from 19.99% to 46.96%. That is a big range with a high threshold. However, based on your employment record and your credit history, you are likely to get interest rates closer to the lower limit.

Their loan size is very flexible, and you can take up an unsecured loan for any amount between $1000 to $15,000. Similarly, for secured loans, you can opt for any amount between $15,000 to $35,000.

You get to decide which kind of loan you want to go for – secured or unsecured. The company does its best at providing you with an assessment of your decision, but the final decision is yours.

You get access to your money in two working days once your loan is approved. Once your loan starts, you have considerable freedom to control how you’d pay for it. You can select any payment frequency model from bi-weekly, weekly, monthly and bi-monthly.

You will also be able to get instant loan approval with an average time of 30 minutes. However, getting so much money instantly can lead to people not paying attention to the terms and conditions. Read through them carefully. See if you can afford to pay the monthly installments and if the rate of interest is something you can afford.

Things you need to be careful about

The cost of the loan would depend upon various factors. The loan size, type, interest rate, and repayment terms will influence the cost factor. Apart from these, you need to be careful about things like:

- Delayed payment fees

- Default penalties

- Missed payment fees

I would recommend anyone reading this blog or thinking of applying for an EasyFinancial loan to plan out their finances in advance to avoid any of these charges. These loans are for a shorter period, and the interest or penalty on any missed payment could be very high. Moreover, if you keep a good track of repaying this loan, your credit score would also improve over time as EasyFinancial reports to Equifax.

How do you get started?

Well, this is a Canada-based service, so you need to be a Canadian resident. You should also be of legal age (which varies depending on your province). If you’re eligible, these are the details you’ll have to provide to EasyFinancial:

- Personal Details – Name, email, phone number, address

- A copy of any government-issued identification

- Address proof

- Online banking details – Financial institution number, bank account number, branch transit number

- Income proof – With details like pay cycle, annual income, and hire date

What’s the final verdict?

EasyFinancial is the ideal lender for people who need money immediately but have a bad credit score. However, no company would take up such a high risk for people with bad credit without having a way of neutralizing those risks. Hence we advise you to read through their terms and conditions before signing an agreement.

They are open to queries, so make full use of that. Talk to their representatives, ask them about the interest rates, payment terms, and other fees. Give them a hypothetical situation to best explain your needs and ask them how they can help you. Doing all of these will help you make an informed decision.