Commodities are naturally occurring goods that are harvested or extracted from the ground, and have long been traded in the financial markets. These raw materials are staples for many of the world’s economies since they’re used to power our homes, create the foods that we eat, and are even manufactured to create the clothes we wear.

Commodities are separated into two categories — hard and soft. Hard commodities are materials that are extracted or mined, such as oil and gold. Soft commodities on the other hand are agricultural materials or livestock, like wheat, coffee and chicken, to name a few.

The most actively traded commodity is crude oil and this desirable liquid is refined to create fuels such as petroleum, diesel, and jet fuel. As a trader, you can take part in oil trading on Plus500, for example, an online trading platform that enables you to speculate on the value of many commodities, including crude oil, without owning the underlying asset.

The commodities market is one of the oldest financial markets and has an interesting history, which we will reveal in this article.

The history of the commodity market

Trading has been ingrained in human nature since civilisations first began. Food, supplies, and building materials would be traded to acquire the items that each party required. Archaeological discoveries suggest that humans began growing crops, and breeding and caring for livestock around 10,000 BC. Their produce would then be traded with other individuals and the practice that we know today as commodities trading was initiated.

Fast-forward to the 19th century, and in the US you’ll find that the trade of agricultural commodities was booming. Buyers in Chicago would purchase supplies from farmlands in the Midwest and store them, before shipping them to the East coast.

Of course, the quality of agricultural commodities like meat and grains, for example, deteriorates over time, and therefore, the price of the asset whilst being stored could change significantly. As a result, the forward contract was born, which enabled the buyer of the goods to pay for the commodity before having it delivered.

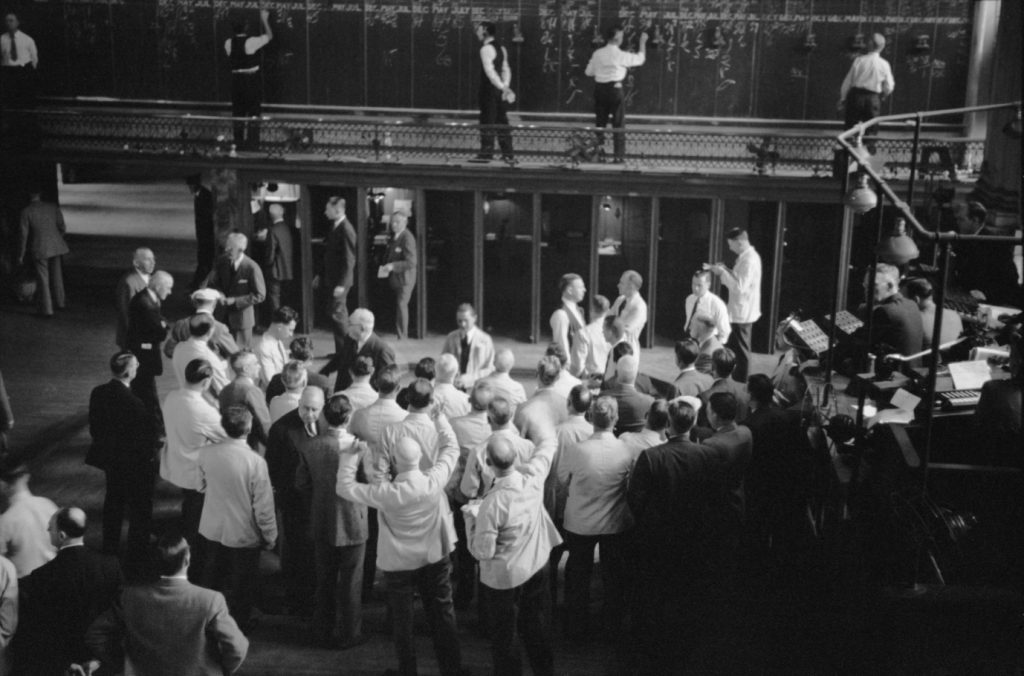

The first American exchange was established in 1848, named the Chicago Board of Trade (CBOT) and these brokers developed the agreement that we know as futures. This was a more reliable and standardised approach to trading, requiring producers and consumers to come to an agreement and secure a purchase price when trading, that would then be paid at a later date.

The present and future outlook for commodities

Today, you can easily open a position in the commodities market because of the accessibility provided by online trading platforms. On these platforms, you can invest in the world’s most popular commodities, employ an economic calendar to keep track of key events and use risk management tools to protect your capital.

You’ll have access to these assets in a centralized, liquid marketplace and by using fundamental analysis and assessing trends, can potentially manipulate short-term price swings in the market in an attempt to make gains on your position.

Oil is the most influential and popularly traded commodity in the market, but as a fossil fuel, it is not renewable and therefore, will eventually run out. This means that we are having to look towards different, renewable energy sources, which will have an impact on the value of oil in the future.

Since oil is refined to fuel our vehicles, the rise of the electric car could eventually contribute to the demise of the oil industry. However, experts believe that electric cars will still only account for a small number of the world’s vehicles by 2035, because of their large price tags and the fact that lower economically developed countries are so reliant on oil.

—

The commodities market is a popular choice among many traders because of the fact that its volatile nature presents you with great profitable opportunities. However, prior to investing, it’s essential that you know what factors can evoke high volatility levels since your capital is at risk.

The commodities market is directly impacted by supply and demand, political and economic events. In addition, because many of the assets are agricultural, their supply may be affected by factors out of your control, like bad weather. Once you have a developed understanding of the market, you’ll be best prepared to open a position in one of the oldest financial markets.