Cryptocurrency in Asia

In Asia, most of the cryptocurrency volume has proven to be by professionals, with an increasing interest from institutional investors who deal with large sums, and thus have a great impact on the cryptocurrency market in terms of volume.

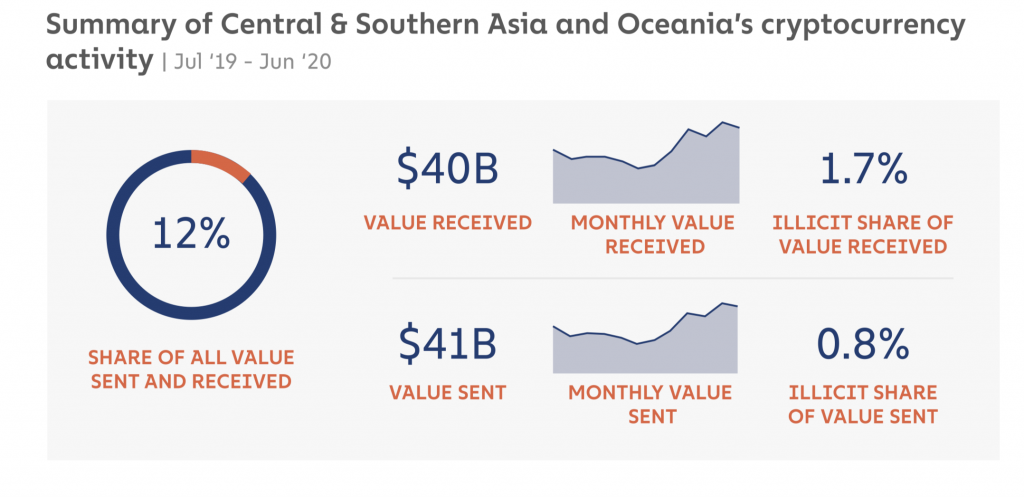

According to The Chinalysis data, this was the summary of Central & Southern Asia and Oceania’s cryptocurrency activity from July 2019 to June 2020:

Cryptocurrency regulations in Asia

East Asia is at the top when it comes to cryptocurrency markets, but the fact is that the activity in transactions declined from October 2019. There are of course many explanations for this, but one important reason was the uncertainty of the government’s plans about potential regulations. In addition, the president announced that China would also potentially present a digital yuan, meaning a digital version of the Chinese national currency by using its own blockchain, known as Central Bank Digital Currency. The speculation of course quickly started as to whether China would ban any new coins whilst still allowing blockchain.

- In 2017, the Chinese government’s banned direct exchanges of yuan for cryptocurrency which also had an effect on the market.

- In recent times, many Asian countries have started to regulate cryptocurrency which obviously has an effect on the market, how it grows, and how people navigate in it. Some of the most important events when it comes to regulations are:

- On the 6th of April 2018, the Reserve Bank of India (RBI), prohibited banks and other financial institutions from dealing with or providing services to people dealing with virtual currencies.

- When it comes to Taiwan, cryptocurrencies are currently not accepted as currencies. Taiwan has called Bitcoin a highly speculative digital virtual commodity and has ordered local banks not to accept Bitcoin nor offer any services that are related to Bitcoin. But apart from that, Taiwan does currently not have any laws or regulations.

- When it comes to Thailand, it was one of the first countries in Asia to issue legislation specifically addressing cryptocurrencies and digital assets. Through its Digital Asset Act in 2018, it regulated offerings of digital assets and certain business activities involving them.

Blockchain permit in Asia

Different countries in Asia have different rules and regulations when it comes to so-called blockchain permits and blockchain licenses in Asia. Depending on the country, there are of course different types of rules and regulations that apply here and how and if they choose to issue сrypto licenses.

Singapore is a country that has made it easier for foreign crypto groups to establish in Singapore in order to serve residents and businesses. At the same time, there are some restrictions with, for example, limits on transaction volumes. In January 2020, Singapore introduced a law that meant companies could apply for a license, which we can call a Blockchain permit. Under this permit, there are approximately 90 digital assets that are involved.

When it comes to Hong Kong, in order to establish a crypto exchange, you need to apply for Type 1 (dealing in securities) and Type 7 (providing Automated Trading Services) licenses. If a company meets these and other licensing requirements, it may be granted a license. In 2021, Hong Kong stated that cryptocurrency exchanges that operate in Hong Kong need to be licensed by the city’s markets regulator and may only provide services to professional investors.

When it comes to Singapore, you must apply for a Recognized Market Operator (“RMO”) or Approved Exchange (“AE”), Capital Market Services License (“CMSL”) which includes dealing in capital markets products as well as offering custodial services if applicable. As far as taxation goes, there is no capital gains tax in Singapore.

The fact that Singapore is one of few Asian countries that have actively worked to introduce a permit for dealing with these kinds of digital assets has been met with great enthusiasm by the community and is set to make Singapore one of the key hubs in Asia when it comes to cryptocurrency and Blockchain, including the offering of services related to them.

As you can see, the view on cryptocurrency and Blockchain varies a lot in different Asian countries. Since it is so early on in the Blockchain market, many countries have yet to decide how they will handle and view cryptocurrency, and potentially also introduce regulations. Some countries are more positive about cryptocurrency than others which sends positive signals for investors and others dealing in this type of business. But what the final outcome will be in a few years when each country and state has taken a stand in cryptocurrency remains to be seen and how they will act with regulations and potentially even introducing their own cryptocurrencies.